47+ how much does mortgage interest deduction save

Use this calculator to determine your. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Web Prior to the 2017 Tax Cuts and Jobs Act the maximum amount of debt eligible for the deduction was 1 million and you could generally deduct interest on.

. Web Most homeowners can deduct all of their mortgage interest. Web Under current law individuals who itemize can deduct interest paid on their mortgage up to 750000 in principal from their taxable income. Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

You may hear that the deduction helps more people afford the costs of owning a. Web Since 2018 the deduction is eligible on mortgages with a principle amount of 750000 or less. Ad Compare More Than Just Rates.

10 Best Home Loan Lenders Compared Reviewed. Web With the interest on a mortgage being deductible when you itemize deductions it may surprise you how much you can save in taxes. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Lock Your Rate Today. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. However higher limitations 1 million 500000 if married.

Over the course of 30 years that annual number. If you took out. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web If you take the standard deduction you cannot also deduct your mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Web Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a. Web Taxpayers can deduct the interest paid on qualified residences for up to 750000 in total mortgage debt the limit is 375000 if married and filing separately.

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web The mortgage interest deduction is a tax deduction you can take for mortgage interest paid on the first 1 million of mortgage debt during that tax year. You can deduct the interest on up to 750000 of mortgage debt or up to 375000 if youre married and filing separately.

Put Your Home Equity To Work Pay For Big Expenses. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. This cap on mortgage.

For 2022 the standard deduction is 25900 for married couples and 12950. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Why Not Borrow from Yourself.

For tax year 2022 those amounts are rising to. Web In other words the Mortgage Interest Deduction would save this American 1163 per year in federal income tax. Web Important rules and exceptions.

Find A Lender That Offers Great Service. Ad Get Instantly Matched With Your Ideal Mortgage Lender. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Comparisons Trusted by 55000000. 16 2017 and later. Homeowners who bought houses before.

Mortgage Interest Deduction Rules Limits For 2023

Home Mortgage Interest Deduction Calculator

Mortgage Interest Deduction Bankrate

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

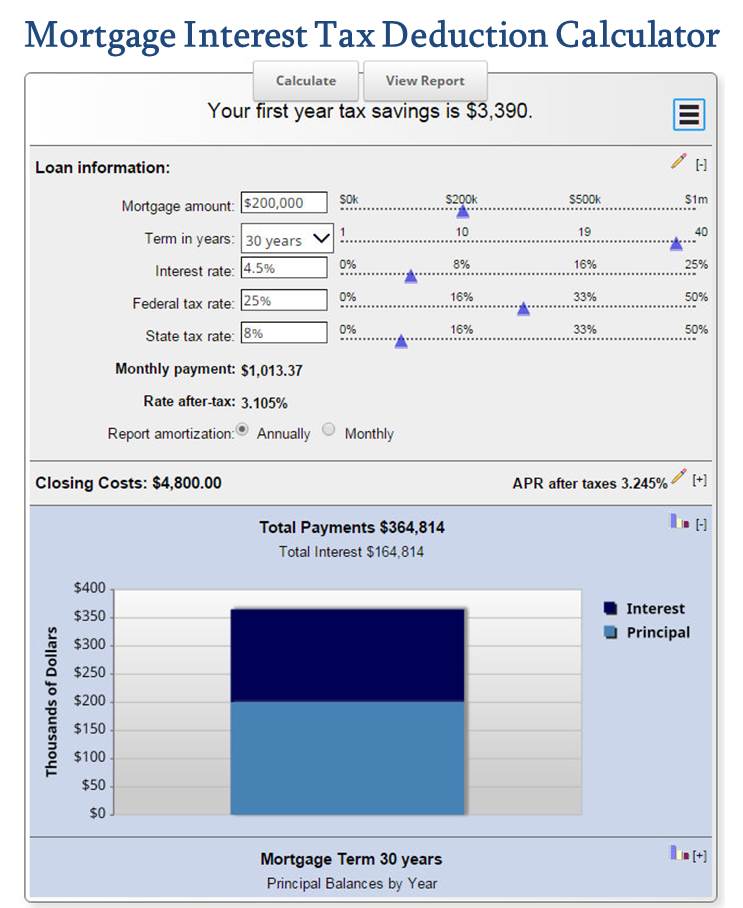

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

The Home Mortgage Interest Deduction Lendingtree

Home Mortgage Interest Deduction Calculator

Mortgage Tax Deduction Calculator Homesite Mortgage

Home Mortgage Interest Deduction Calculator

Mortgage Interest Tax Deduction Calculator Mls Mortgage

:max_bytes(150000):strip_icc()/GettyImages-1282179800-9e2c7156becb49d892d01207b646e7ce.jpg)

Tax Deductions For Interest On A Mortgage Refinancing

Keep The Mortgage For The Home Mortgage Interest Deduction

Race And Housing Series Mortgage Interest Deduction

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Calculating The Home Mortgage Interest Deduction Hmid

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Bc New Homes Guide Mar 6 2015 By Nexthome Issuu